JPMorgan Chase Institute Releases Report on Early Impact of COVID-19 on Small Business

The JPMorgan Chase Institute has released research on the early impact of COVID-19 on small business finances—including cash balances, revenues, and expenses—during the initial phase of the pandemic through April 2020. The report also highlights the metro areas, industries, and demographic groups most impacted.

Here are a few key findings:

- Small business cash balances dropped 12.7 percent and revenues dropped as much as 50 percent at the onset of COVID-19, but balances rebounded by the end of April. Balances declined across metro areas, but there was variation in the extent of the impact.

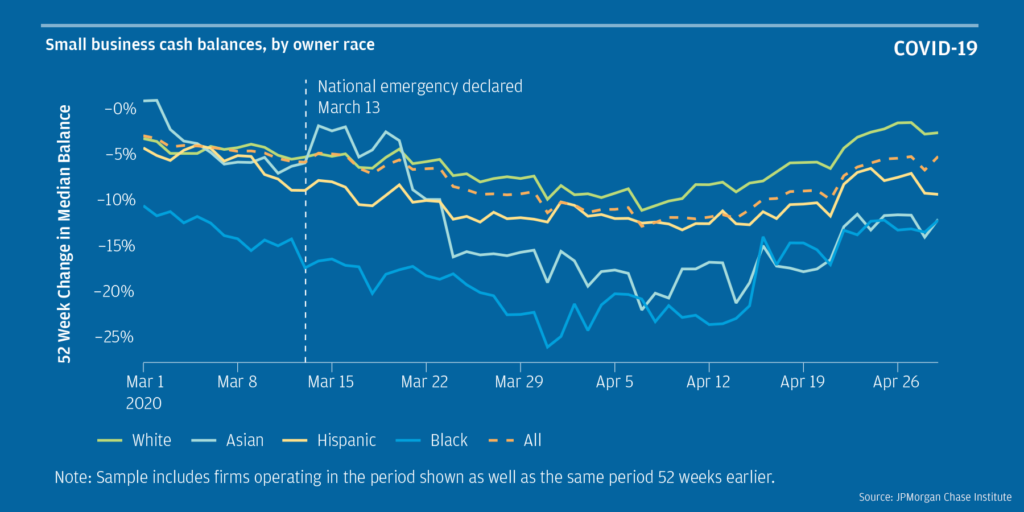

- Black- and Asian-owned businesses had larger declines in balances and revenues than White-owned businesses. Black-owned businesses’ cash balances were down 26 percent at the end of March, whereas White-owned businesses’ cash balances were down less than 10 percent.

- Restaurants and personal services businesses (e.g. salons, dry cleaners) had the largest decline in cash balances and revenues. Restaurant cash balances declined 48 percent and personal services cash balances fell nearly 40 percent.

Read the full report.