OFN Conference Reflections: Investing in Climate Solutions for the Environment and the Economy

This abridged post was written by OFN blog guest author Keith Bisson, president at Coastal Enterprises, Inc (CEI). See full article on the Confluence Philanthropy blog.

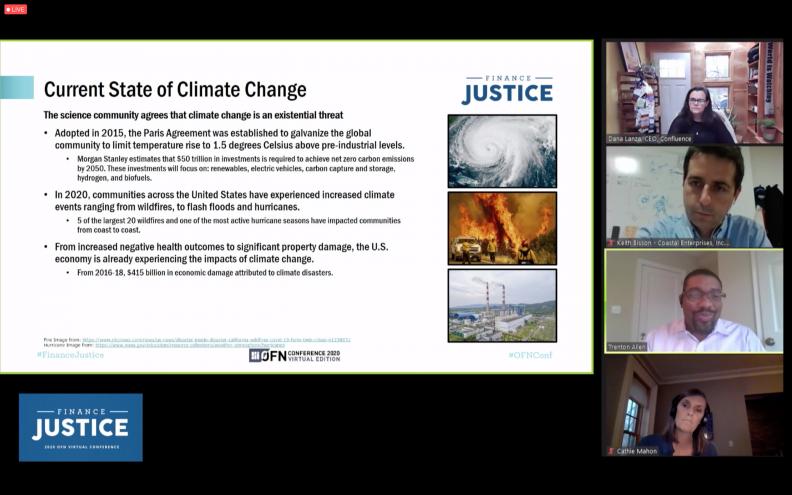

During a November 12 panel “Investing in Climate Solutions for the Environment and the Economy” at the virtual 2020 OFN Conference, I had the honor to represent Coastal Enterprises, Inc. (CEI) on a panel with Dana Lanza of Confluence Philanthropy; Trenton Allen of Sustainable Capital Advisors; and Cathie Mahon of Inclusiv, the federation of community development credit unions.

The panel sought to introduce climate positive finance to CDFIs. The premise was that a growing movement is pushing for a future-looking economy: one that takes the urgent challenges of a highly inequitable economy and a changing climate as a charge for audacious action. Climate positive investment is a powerful tool for addressing climate change and creating jobs, community resiliency, and energy affordability and reliability, especially for communities of color, Native communities, and others that are under-resourced and left behind.

This work is a priority for us in Maine, which is the most rural state in the country with a more dispersed population and notoriously cold winters. Rural Mainers don’t have a choice about whether or not to heat their homes or travel longer distances to their jobs. Volatile energy and fuel costs disproportionally affect rural residents and people with low incomes, who also bear the brunt of the negative impacts of climate change. Clean energy investments, while benefiting all Mainers, especially help the most vulnerable by reducing/stabilizing expenses and contributing to positive climate action, in addition to supporting the creation of good quality jobs.

During the panel, I shared CEI’s story about investing in climate positive projects in Maine, including an example of municipal solar array in rural Maine that will power all of the town’s municipal buildings and demonstrates the contagious nature of clean energy. I also shared CEI’s participation in the network that developed the Platform for Carbon Accounting Financials, which will allow us to understand the carbon exposure of our loan portfolio. In tandem with our own greenhouse gas inventory, which we’ve completed for the past three years, we are identifying how we can have the greatest impact with the tools we have.

In closing, I shared a vision for funders to recognize the role and power of CDFIs. There are 1,100 CDFIs across the country, mostly place-based organizations that can tailor their services to the needs of their communities, especially front-line and low-income communities who would benefit the most. But many CDFIs have not yet engaged with what we think of as climate positive finance and will need support. In addition, we need to invest in policy advocacy to ensure that local solutions can be scaled up and have broader impact. If and when federal climate policy is developed, the voice of CDFIs needs to be at the table.

Visit the OFN Conference recap website for a recording of our session.