OFN Members Testify on Capitol Hill

MacKenzie Bills, Senior Public Policy Associate, and Sofia Gilkeson, Public Policy Associate, Opportunity Finance Network

Read time: 5 minutes

Two leaders at OFN member organizations advocated for the CDFI industry and Native and other underserved communities during testimony to Congress

Earlier this month, representatives of two OFN member organizations appeared before House and Senate committees and delivered testimony to elevate the CDFI industry and its ability to get capital to people and places that need it most.

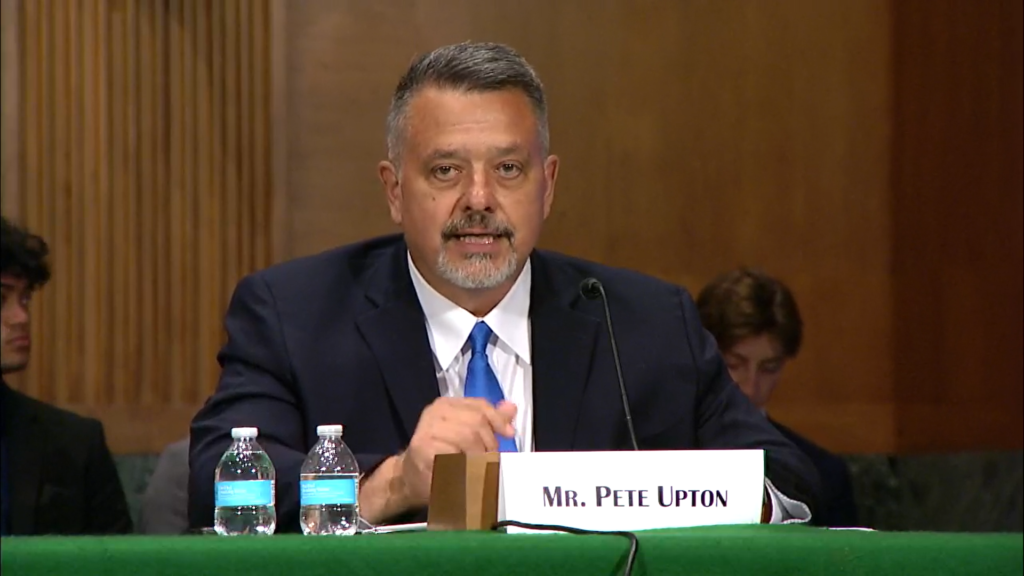

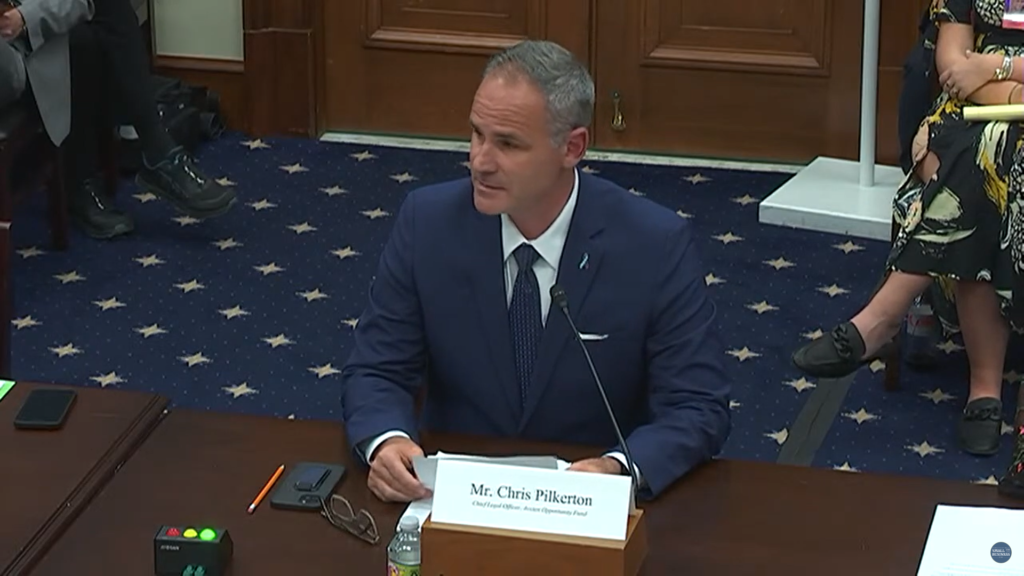

Pete Upton, CEO of Native CDFI Network and executive director of the Native360 Loan Fund, underscored Native CDFIs’ vital role in providing housing to Indigenous communities. Chris Pilkerton, chief legal officer at Accion Opportunity Fund, highlighted the critical role CDFIs play in providing capital and technical assistance to small businesses.

On June 13, the Senate Committee on Banking, Housing, and Urban Affairs Subcommittee on Housing, Transportation, and Community Development held a hearing, “State of Native American Housing,” where Upton delivered testimony.

The hearing featured a panel of witnesses representing Native housing organizations across Indian country, including the National American Indian Housing Council, Minnesota Tribal Collaborative to Prevent and End Homelessness, and Northern Arapaho Housing Authority.

In her opening statement, Senator Cynthia Lummis (R-WY), a member of the Senate Community Development Finance Caucus, recognized the work of Native CDFIs as “a vehicle for economic growth in communities that have often faced barriers to accessing capital and financial services.” She emphasized the role of the caucus to “address the needs of CDFIs so that they have the resources to serve their communities.” And she went on to say that “CDFIs are a wise investment to multiply our federal dollars for maximum impact.”

Members of the subcommittee expressed concern over the significant lack of affordable housing for Indigenous communities, barriers to homeownership on Tribal lands, and the state of existing housing, much of which is plagued by serious plumbing and electrical problems.

Upton discussed the vital role that Native CDFIs play in growing Native homeownership, increasing access to capital and financial services to Indigenous populations and communities, and providing financial education. Upton underscored Native CDFIs’ ability to have a considerable impact on the affordable housing crisis in Native communities.

In response to Senator Lummis’ question about Native CDFIs’ ability to work on private trust lands, Upton said, “Native CDFIs in fact are most successful on trust lands. In South Dakota, of the 86 loans closed last year equaling $7 million, CDFIs made up 85% of the lending.”

Senators participating in the hearing recognized existing federal appropriations for Native housing programs and the need to increase appropriations for key programs including the Native American Housing Assistance and Self Determination Act of 1996 (NAHASDA), Indian Housing Block Grant Program (IHBG) and the Native American Direct Loan (NADL) program.

Next door that same day, the House Committee on Small Business held a hearing titled “Assisting Entrepreneurs: Examining Private and Public Resources Helping Small Businesses.” As a witness for this hearing, Pilkerton highlighted the importance of technical assistance as a critical component of a small business’s ability to develop, hire, and scale.

Pilkerton shared his experience as a former SBA Administrator and government official. When he left the public sector, he said, he chose to work for a CDFI to ensure mission lenders have a seat at the table with other financial institutions.

“The services [CDFIs and MDIs] provide are critical, and the outreach that they have to these communities of color, women, rural areas, and other groups are the piece that is missing from the financial services system, so the more support that they get from the private sector enhances that opportunity,” Pilkerton said.

OFN members play a key role in raising the visibility of the CDFI industry on Capitol Hill, lending their expertise and sharing success stories from their local communities with policymakers.

Visit our policy action center to learn more about how to build relationships with your Members of Congress and become a voice for CDFIs and your community.

Amplify your CDFI stories

Your client success stories illustrate what it means to deliver opportunity for all. Share your client success stories and showcase your work.

Join CDFI peers in Minneapolis for training

The OFN and Native CDFI Network’s (NCN) joint Midwest Regional Meeting (July 11) is SOLD OUT! However, you can still join us for new OFN training opportunities (July 10 & 12).

Stay Connected with OFN

Subscribe to receive regular updates from OFN straight to your inbox.

Follow OFN on social media.

News, stories, and voices from OFN and the CDFI field. View more on our blog!