House Appropriations Committee Proposes Consistent Appropriation Amid Echoed Concerns Over FY25 Funding Release

Lily Jin, Associate, Public Policy, OFN

Several committee members expressed concern over the status of FY25 CDFI Fund obligations while the committee approved $276.6 million for the CDFI Fund in FY26.

Read time: 4 minutes

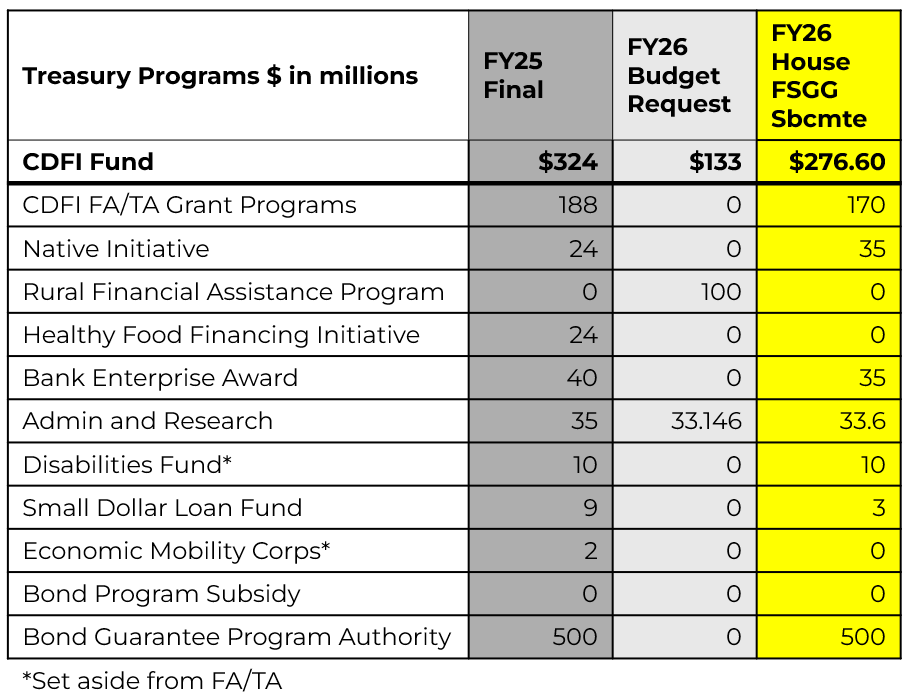

This week, the House Appropriations Committee voted to approve its fiscal year 2026 Financial Services and General Government Appropriations bill, proposing a 7.9% cut from spending levels enacted in FY25. Although the allocated $276.6 million for the CDFI Fund is more than the $134 million requested in the president’s budget proposal, it remains $47.4 million below the current FY25 appropriation.

The proposal is level with last year’s House proposal and continues to fund the majority of core CDFI Fund programs. For a more detailed breakdown of the bill, read our last update on appropriations here.

During the full committee markup, several members of the minority raised concerns over the remaining unobligated FY25 CDFI Fund appropriations, as well as the lower level of proposed funds for FY26.

Representative Madeleine Dean (PA-04) stated the funding cut “comes after a recent OMB document revealed that as much of 75% of the FY25 CDFI Fund funding remains unobligated.”

Representative Frank Mrvan (IN-01) added that “the bill harms economic development through severe funding cuts to the Community Development Financial Institution [Fund], reducing their capability to provide financial services, loans, and affordable housing in low-income communities.”

The committee also approved a $974.7 million proposal for the Small Business Administration (SBA) — a 25% cut from the FY25 enacted level but above the president’s budget request to zero out entrepreneurial development programs. More specifically, the subcommittee proposed $41 million in funding for Microloan Technical Assistance, $5 million for the Native American Outreach Program, $27 million for Women Business Centers, and $26.5 million for Veterans Outreach. The subcommittee also increased the 7(a) loan program limit by $10 billion, which is carved out solely for American manufacturers.

In the bill’s report language, the committee reiterates their support of these programs—

“SBA shall not reduce these non-credit programs from the amounts specified above and SBA shall not merge any of the non-credit programs without advance written approval from the Committee. The Committee strongly supports the development programs listed in the table above and will carefully monitor SBA’s support of these programs.”

Additionally, SBA appropriation includes two administrative provisions that prohibit the SBA from funding climate change initiatives and requiring small businesses to report data on services provided to minorities and women.

The Senate must still draft their Financial Services and General Government (FSGG) bill for FY26, and the House and Senate need to come to an agreement to keep the government funded by September 30. Strain on bipartisan negotiations has increased after the White House proposed another $5 billion rescissions package last week. With fewer than 15 days left in session before the end of the fiscal year and diverging strategies from within both parties, leadership on both sides would need to swiftly align on their respective paths forward in order to avoid a government shutdown.

In addition to advocating for level funding at $324 million for the CDFI Fund in FY26, OFN has leveraged this appropriations cycle to keep attention on the delay of full disbursement of CDFI Fund awards. Ahead of the full committee markup, OFN worked with CDFI allies on the committee to address the spending holdup during the hearing.

Representative Ed Case (HI-01) highlighted that “this committee has consistently supported the CDFI Fund” and that “this is not a partisan issue” while referencing the letter sent by a bipartisan group of 26 senators in July to the Office of Management and Budget (OMB).

House FSGG Ranking Member Steny Hoyer (MD-05) and Representative Betty McCollum (MN-04) echoed the importance of these funds to communities.

The CDFI industry and its allies must continue pressing the issue with members of Congress to call on OMB to fully deploy FY25 funds. If you live in a Republican-led state or district and would like to maintain the momentum, use OFN’s Policy Action Center to tell your Members of Congress why the CDFI Fund is essential to your community!

Save The Date

Join us from October 20-23 in Washington, D.C. for the 41st annual OFN Conference!

Stay Connected

Subscribe to receive regular updates straight to your inbox and check out our blog for the latest coverage from OFN and the CDFI industry.

Follow us on social media.

More From OFN

-

House Appropriations Committee Proposes Consistent Appropriation Amid Echoed Concerns Over FY25 Funding Release

Several committee members expressed concern over the status of FY25 CDFI Fund obligations while the committee approved $276.6 million for… Read More

-

Meeting Entrepreneurs Where They Are: ProsperUs Detroit’s Community-First Microlending

CEO Paul Jones shares how ProsperUs pairs flexible capital with coaching to turn ambition into local wealth. ProsperUs is helping… Read More

-

Helping Small Businesses Save with Energy Efficiency

A Guide for Community Lenders to Unlock Cost-Saving Opportunities for Borrowers Small businesses are particularly susceptible to high energy costs… Read More